What's on your "hot list" to read this week? If we had to guess, we'd bet your insurance policy probably didn't make the cut. After all, it's filled with confusing terms that can be rather intimidating to even the most seasoned reader. However, there are several important terms in your policy you should become familiar with that have the power to impact your coverage in a big way: Depreciation, Actual Cash Value (ACV), and Replacement Cost Value (RCV).

According to CFM Claims Manager, Scott Lightfoot, many policyholders don't know what type of policy they have until the time comes to file a claim, which as you can imagine, makes for a complicated claims process. To better understand your insurance policy and the claims process, let's cut straight through all that jargon with the help of Lightfoot, who has over ten years of experience in the insurance industry.

Depreciation

Over time, your dwelling and most of its contents lose value due to a variety of factors like age and natural wear and tear. This devaluation is referred to in the insurance world as depreciation. Lightfoot uses a standard depreciation guide to determine the life expectancy of materials when working through a claim.

Lightfoot uses a standard depreciation guide to determine the life expectancy of materials when working through a claim.

*It's important to note that your deductible will always be factored in before a payout occurs with any claim. Your deductible might be $500, $1,000, or more. If you have a claim estimation valued below your deductible, you'll be responsible for paying for all damages out of your pocket. If your claim estimation is valued above that deductible figure, your payout will be for damages over that deductible amount. The T.V. claim example being used throughout this blog is meant to inform readers in an understandable and relatable way. While the T.V. in this scenario costs less than a typical deductible, under a realistic circumstance, it might be considered one item in a long list of personal property inventory turned in by a policyholder at the time of a claim.

Actual Cash Value (ACV)

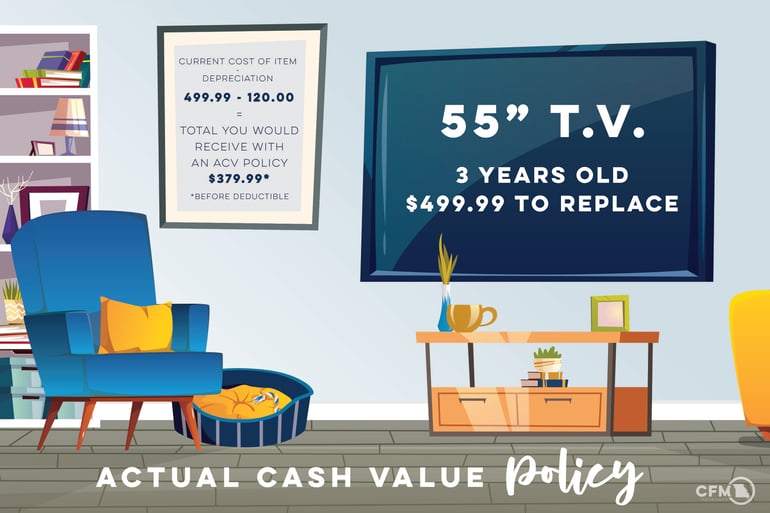

The initial payment reimbursed to a policyholder after they file a claim is for the Actual Cash Value (ACV) of their damage. Lightfoot explains further,

Many seeking insurance are quick to sign up for an ACV policy because it's more affordable. However, Lightfoot warns this cost savings upfront can lead to larger expenses in the future.

Replacement Cost Value (RCV)

Replacement Cost Value (RCV) is the amount of money it takes to replace what's been damaged in a claim, less the deductible. Simply put, it allows you to bounce right back into the same position you were in prior to a loss.

Lightfoot also notes that the market plays a huge part in determining what cost actually gets paid out to the policyholder:

Lightfoot also notes that the market plays a huge part in determining what cost actually gets paid out to the policyholder:

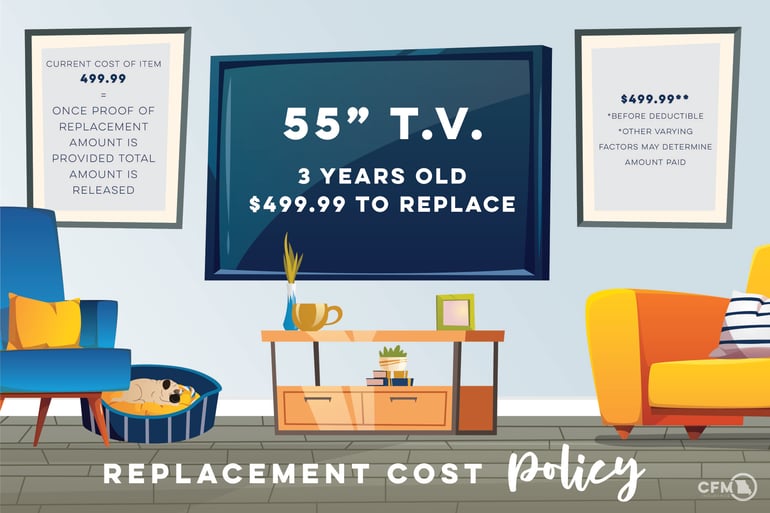

Example: If you have a Replacement Cost policy, you can expect the most ideal payout for your destroyed 55" T.V. - the amount you paid for it originally, less your deductible.

In an RCV claim scenario, policyholders can expect to go through a 2-step process of recovering their full payout.

You can anticipate receiving two checks before being fully compensated when your loss settlement is on a replacement cost basis. The first check will be for the actual cash value of the items. After you turn in proof you've replaced the items to your adjuster, you'll receive the final payment of your claim (depreciation). To make sure all the items lost are replaced, it's wise to keep a running list of your expenses, complete with receipts, to submit to your adjuster.

Make Sure Your Policy Works For You

If you're not sure whether you have ACV or RCV, check the Declaration Page of your insurance policy. It will state what type of policy you have, along with breaking down your coverage, discounts, and more. You may find that page by pulling out the physical copy of your policy, but you can also scan through it quickly and easily by viewing it in the CFM Policyholder App. Meeting with your local agent annually to go over your coverage tends to be most helpful in determining whether or not your current policy-type works for you. They're insurance experts - trust your agent to advise you on what kind of policy will best protect you as your needs change throughout the years.

When it comes to which policy-type is generally more beneficial than the other, Lightfoot's pick is simple:

Your Comments :