Sure, owning a home is the ultimate adulting goal for many Americans. But, if you're one of those cool, no-strings-attached types of grown-ups, you understand that renting offers its own set of undeniable perks the American Dreamers tend to overlook. You're not tied down to a lengthy mortgage and fluctuating annual property taxes. If something at your rental breaks, you're off the hook to make repairs and foot the bill. And insurance costs for renters are significantly less than they are for homeowners - which means more money in your pocket for traveling, splurging on the latest tech, or shamelessly ordering Door Dash meals every night.

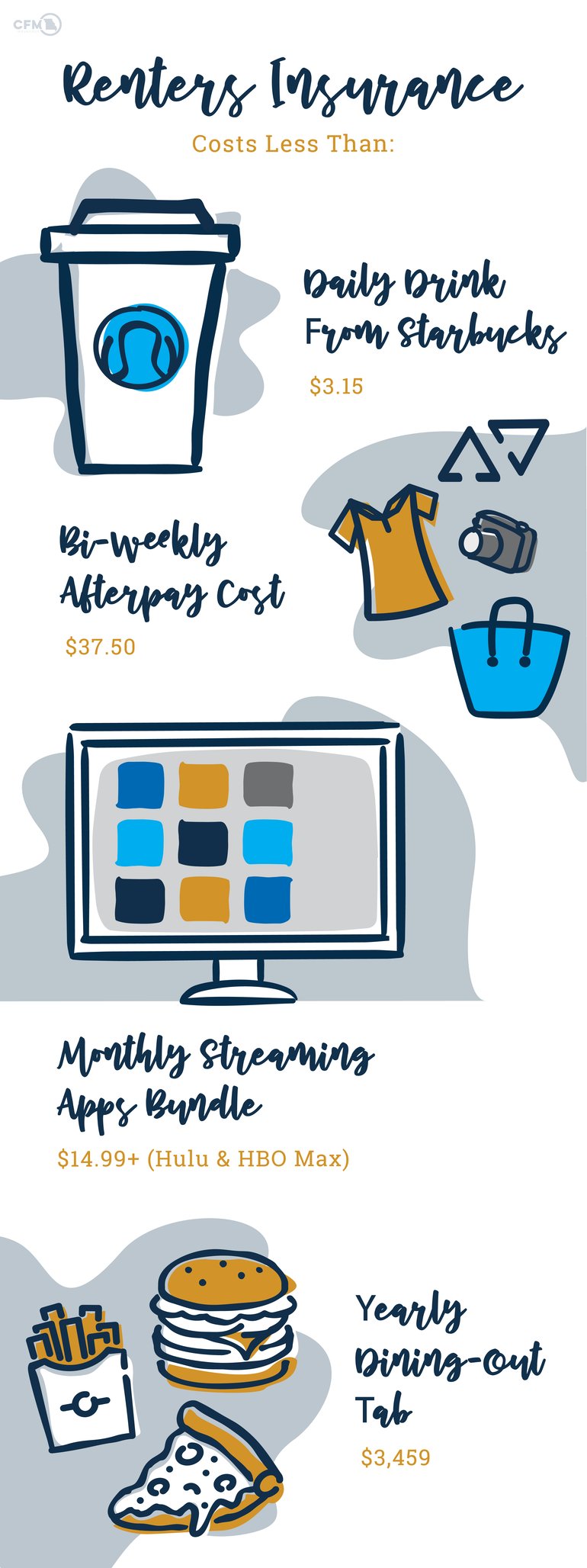

Speaking of renters insurance - you have that, right? If you don't, you definitely should. Not only is it cheap - renters insurance in Missouri only costs $8-21 a month for $20,000-$30,000 of coverage - but it also protects you against catastrophic damage to your personal property and potential legal liabilities. After all, the flip side of not having a renters policy means you funding any losses to your property or potential lawsuits out-of-pocket.

Still on the fence about whether or not it's "worth" having? Let us paint the bigger picture for you real quick about why renters insurance will never ever be a "waste" of money:

Okay, enough chit-chat about money - let's talk coverage. Obviously, we're going to break down the basics of renters insurance in Layman's terms (because who has time for confusing insurance jargon?), but we'll also:

- Dish out a few real-life claim scenarios to help you fully appreciate the value of a renters policy.

- Debunk some of the most common misconceptions surrounding this thing called renters insurance.

- Determine how much coverage you may need, according to the money you've invested in your stuff.

Simple enough? Here's the renters insurance rundown.

Break It Down Now: What's Covered & What's Not?

Covered:

1. Personal PropertyPersonal Property coverage refers to all of the things owned by you that fill up your place. Keep in mind that personal property coverage will not pay to replace your roommate's stuff or your any furnishings or appliances supplied by your landlord. Those two parties will both need their own separate insurance policies to cover those items. But, if your clothing, appliances and furniture, jewelry, or electronics get damaged or destroyed by a covered peril on your policy, your renters coverage will step in to restore your loss. Covered perils include fire, theft, and weather events.

Fun Fact: The food in your fridge is covered under "Food Spoilage" on your renters policy! That's right - all those expensive groceries you just packed your fridge and/or deep freeze with would be covered if they spoiled due to a covered mechanical breakdown, for example. Your renter's policy can't replace the now non-functioning fridge that stored your food since it's your landlord's - their policy covers that - but it can replace the groceries that were in it when it stopped working. CFM Renters policies cover up to $500 worth of food, without any deductible - score!

2. Additional Living Expenses (ALE)

In the event that a covered loss, such as a home fire, renders your rental uninhabitable, your renters insurance coverage will help pay for your temporary living expenses at a different location. That means if you need to stay in a hotel for a bit and buy new clothing and food to carry you through your difficult time, your policy will take care of those costs until you're able to get back on your feet at a new place.

Not Covered:

1. Natural Disasters (Floods & Earthquakes)Natural Disaster instances require their own separate insurance policies. Luckily, Missouri doesn't see many earthquakes, but if your place is in an area that regularly experiences flooding, sinkholes, and mudslides, be warned that renters insurance won't cover damage to your things from Mother Nature's worst attacks. If you feel the threat for one of those occurrences happening to your pad is high enough, you can purchase additional inland flood and earthquake coverage from yours truly. You'll just need to give one of our agents a call to weigh your coverage options.

It's also important to note: Damages and expenses from a more common occurrence in our state - widespread power outages from spring and summer storms - won't be covered by renters insurance.

2. Your Roommate's Stuff

3. Damage Caused By Pests

If icky critters like mice, termites, or other vermin become unwelcome roommates in your rental, any damage they cause to your belongings won't be covered by your renters policy. If you notice signs of a pest infestation, contact your landlord immediately so they can have a licensed professional exterminate them properly.

4. Undocumented Valuables

Say you have an expensive engagement ring, watch, or electric guitar hanging out in your pad a thief breaks in to swipe them all. If you didn't have those high-dollar items listed out, line-by-line under your policy terms, they may not be covered. If your insurance company has no documentation those items ever existed, it could make it more difficult to prove they were actually owned by you and estimate their payout value in a claim scenario. Make sure you keep an updated home inventory of everything you own - not just the expensive items - so your adjuster can have a record of them if they ever become damaged or destroyed by a covered peril.

5. Property Damage To Your Physical Home

Any damage to the actual structure you reside in as a tenant would not be covered by your renters policy - that's where your landlord's insurance would step in. But as the person living there 24/7, it's your job to immediately report any deteriorating conditions around the house so your landlord can quickly make repairs and avoid any long-term structural damage or claims down the road.

Your Landlord's Policy Covers:

1. Anything structural - not contents.Break It Down Now: Who's Responsible For That?

And now - in our most convincing gameshow host voice (think Regis Philbin vibes) - we say: Let's play a round of "Who's Responsible For That?" *cue crowd applause*

Okay, okay: all jokes aside, sometimes the lines can get blurred between who should claim responsibility for what in a renting claim situation. So, we're going to toss a few real-life loss scenarios out there for you to digest and then leave this blog a more informed tenant.

Loss Scenario 1: Your next door neighbor is mowing and flings a rock or two over into your window in the process, breaking it.

Who's responsible? Your landlord. Because a broken window is considered structural damage, your landlord would be responsible for fixing it.

Loss Scenario 2: While you were at work, the apartment above you had a pipe burst, sending water gushing all over their pad and yours. Water seeped through the ceiling and found your 75-inch flat screen TV in the process. It's now fried.

Who's responsible? Both. We can explain: Your landlord's policy won't pay to replace your expensive TV or any other personal property that was damaged or destroyed by the water, but your renters policy will. However, any water damage and resulting mold or mildew growth that affected the structure of your apartment would be your landlord's responsibility to fix as they manage your building complex.

Loss Scenario 3: You went out last night with friends to celebrate your promotion at work - congrats! Instead of taking an Uber back to your place, you decide to crash at your bestie's house. While you were away, someone broke into your apartment and swiped your brand new MacBook Pro, some precious jewelry that's been in your family for generations, and the flat screen TV from your living room.

Who's responsible? You. If none of the property that got stolen belonged to your landlord, it's up to you to file a theft claim on your renters policy to replace what was lost. Because CFM renters policies come with replacement cost coverage, your adjuster would estimate a total value for what was stolen based on current products of similar like, kind, and quality on the market today.

Break It Down Now: Renters Insurance Myths Debunked!

Renters insurance is so misunderstood. As you now know for certain, your landlord's policy won't pay out any extra dough for damage to your personal things in a claim situation. That's probably the number one myth surrounding this topic and there are a few others floating around out there that we can quickly debunk.

Myth: My parents' homeowners policy will cover me, so I don't need my own separate renters policy.

Myth: My stuff isn't worth much so a renters policy isn't really necessary.

Myth: Renters Insurance is probably expensive - I can't afford that.

Reality: Ok, we've already convinced you of the lies behind the above statement so we'll keep this description short and sweet. If you can afford to buy a cup of coffee every day, pay for that monthly bundle of streaming subscriptions crowding up your fire stick, and order takeout basically every night (no judgements), you can afford renters insurance to keep your things safe. Monthly rates can start as low as $10. Need we say more?

Myth: Between work, going out with friends, and traveling, I'm hardly ever home. Why get renters insurance if I'm never even at the place I'm renting?

Reality: Perhaps you’re one of those people who only head to their apartment to crash after a long day of work (or a long night of fun). Why get renters insurance if you’re basically never at the apartment you’re renting? The reason is that your policy has your back whether you’re at home or at a bar, coffee shop, airport, party boat, park, mall, subway car, outdoor rave, therapist’s office… you get the idea.

Myth: It's such a long, drawn-out process to sign up for renters insurance. Ain't nobody got time for that.

Reality: We can't speak for other insurance companies, but with CFM, signing up for renters insurance is literally as easy as 1, 2, 3. If you've got 5 minutes, we've got binding coverage. Oh, and don't worry - it can all be done online. Click here to check out the quick, seamless process.

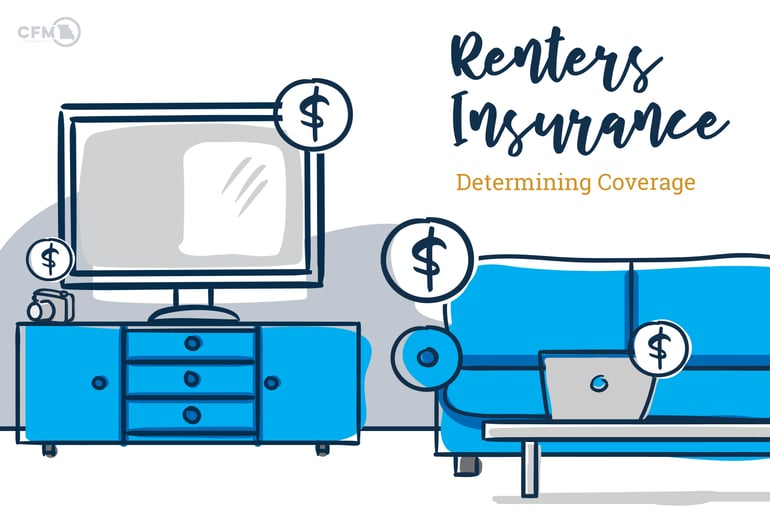

Break It Down Now: How Much Coverage Do You Actually Need?

Now that you're crystal clear on what renters insurance covers you're probably wondering how much coverage you realistically need. We're talking about that magic number that lets you know you're protected, but still getting the most bang for your insurance buck. Here are a couple of things to keep in mind when determining how much coverage would match the value of your stuff.

1. Choose appropriate coverage limits based on your property inventory numbers.

Take the afternoon and figure out exactly what you have and what it's worth on paper. Then, keep a running record of your home inventory on an app linked to your smart phone or laptop. This updated home inventory will be extremely helpful to your adjuster in determining your claim payout, should you ever need to file one.

Once you have an accurate idea of how much your personal property is worth, you can choose the appropriate coverage limits for your one-of-a-kind renters policy. CFM's property coverage limits range from $10,000 - $40,000. Of course, if you need additional coverage for your more pricey items or collections, that can be easily added to your policy with the help of a trusted CFM agent.

As for your personal liability limits, keep in mind that medical expenses are on the rise so it may be wise to choose a higher coverage amount. CFM's personal liability limits range from $100,000 - $500,000 giving you plenty of room to work with if a claim ever came about.

2. Don't forget to factor in your deductible.

What is a deductible, you ask? Well, it's the portion of an insurance loss (in dollars) paid by you, the policyholder. Deductibles can range anywhere from $500 to $10,000. Your insurance deductible amount can affect your premium, so if you're looking to keep your monthly premium payment down, select a higher deductible. But, if you're looking to pay less out-of-pocket in a claim scenario, shoot for the lower deductible. Make sense?

So You're Ready To Buy Renters Insurance? CFM Has You Covered.

We may be a slightly old - we mean mature - insurance company, but we know what the younger generation of renters want in a policy and the process to get it. Ease of business is the name of our game because we know it's a top priority for our customers, so we spent a good chunk of time developing a quick, seamless online quoting process specifically for our renters market. If you're ready to see for yourself just how affordable and simple it is to get covered today, head over to our Renters Page starring the guru of renting's little mishaps, Tuck.

Your Comments :